In the fast-paced world of trading, the thrill of the market can be compelling, yet the financial risks can be daunting. For aspiring traders and seasoned investors alike, the idea of experiencing the adrenaline of trading without the potential for monetary loss presents an appealing prospect.

Fortunately, there are innovative methods to simulate real trading experiences, allowing individuals to navigate the complexities of the market in a risk-free environment. From virtual trading platforms that mirror real-time market conditions to immersive simulation tools that challenge your strategies, these alternatives offer an excellent way to hone skills, test theories, and build confidence.

As we delve into this intriguing realm, well explore various approaches that empower traders to learn the ropes, refine their tactics, and prepare for the financial battlefield—all without putting a single cent on the line. So, whether youre a novice eager to dip your toes into the trading waters or a veteran seeking to sharpen your edge, the world of simulated trading awaits you.

Introduction to Simulated Trading

In the ever-evolving landscape of financial markets, the concept of simulated trading emerges as a beacon for aspiring traders seeking to hone their skills without succumbing to the perils of real financial risk. Imagine a vibrant arena where the stakes are high but the currency is merely digital; here, one can experiment with strategies, learn from mistakes, and gain invaluable insights.

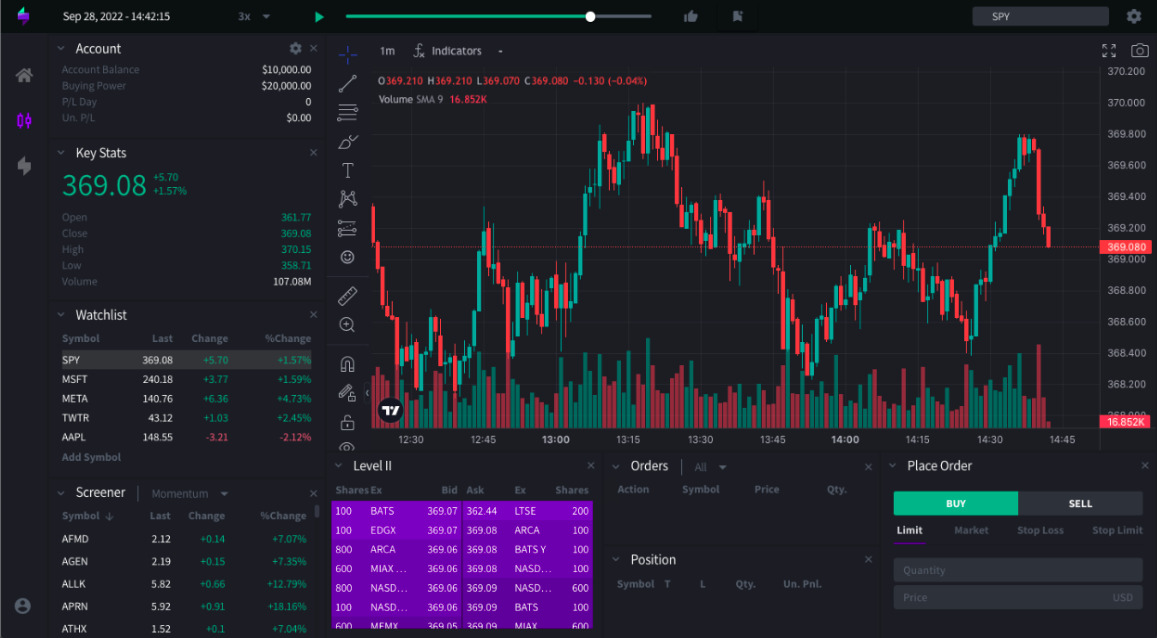

A market replay simulator can be particularly valuable in this context, allowing traders to replay past market conditions and analyze their actions to better understand the outcomes. Simulated trading environments mimic the complexities of actual trading, offering a playground for novices and seasoned investors alike to develop their instincts and refine their techniques.

With the freedom to explore various scenarios—from bull markets to bear trends—traders can dissect their decisions and cultivate a robust understanding of market dynamics. This approach not only enhances confidence but also equips individuals with the tools necessary to navigate the unpredictable waters of trading when they finally step into the arena of real investments.

Choosing the Right Trading Simulator

Choosing the right trading simulator is pivotal in crafting a realistic and enriching learning experience. With a plethora of options available, its essential to consider key features that align with your trading goals.

Look for simulators that offer a diverse range of assets—stocks, forex, options, and cryptocurrencies—so you can experiment across various markets. User interface matters too; a well-designed platform that feels intuitive can enhance your focus and strategy development.

Additionally, seek out simulators that provide real-time data and analytics, as this can mimic the fast-paced nature of actual trading. Some platforms even allow you to customize market conditions, affording you the chance to navigate scenarios from bullish rallies to bearish downturns.

Ultimately, the right simulator should not only challenge your decision-making skills but also build your confidence—transforming initial hesitations into calculated strategies. Choose wisely, and you might just unlock the secrets of successful trading without the fear of financial loss.

Setting Up Your Trading Simulation

Setting up your trading simulation is a crucial step in honing your trading skills without the shadow of financial loss looming overhead. Begin by selecting a reliable trading platform that offers a robust simulation feature; look for tools that mirror real-time market data and let you practice various trading strategies.

Next, consider defining your objectives: Are you aiming to master day trading techniques or perhaps delve into the intricacies of long-term investing? Once your goals are established, allocate virtual capital that mirrors your real-world budget, providing a more tangible context for your decisions. Don’t shy away from experimenting; push the limits of your strategies—after all, this is a risk-free environment.

Finally, keep a detailed journal of your trades, noting successes, failures, and the emotions that surfaced throughout your simulation. This reflection will deepen your understanding and prepare you for the real high-stakes trading landscape.

Conclusion

In conclusion, simulating real trading experiences without the financial risk is an invaluable strategy for both novice and experienced traders looking to refine their skills and strategies. By utilizing tools like a market replay simulator, individuals can immerse themselves in past market conditions, making real-time decisions based on historical data.

This approach not only enhances trade execution skills but also allows traders to learn from their mistakes in a risk-free environment. As technology continues to evolve, aspiring traders now have more opportunities than ever to practice and prepare themselves for the complexities of the financial markets.

Embracing these simulation techniques can ultimately lead to greater confidence and success in actual trading scenarios.