Navigating the world of finance can often feel like trying to unravel a complex puzzle, where every piece holds the potential for both reward and risk. Understanding the intricate mechanics of the market is no small feat; it requires more than mere theoretical knowledge.

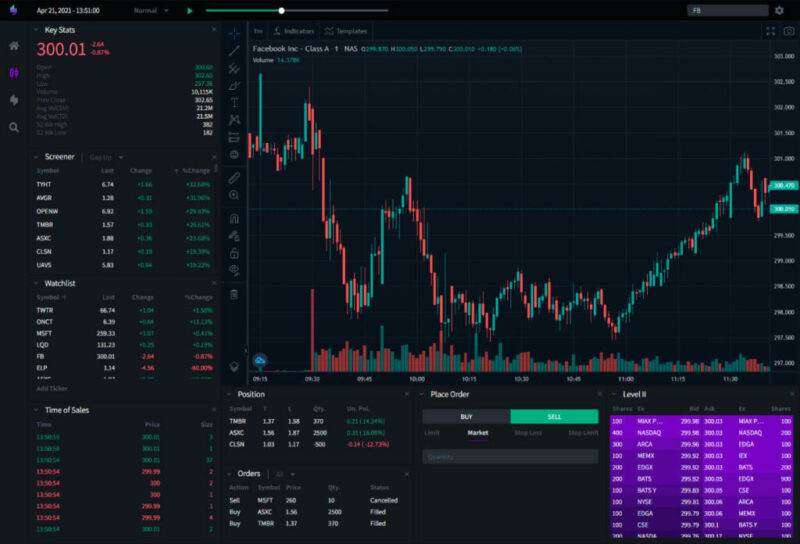

Enter trading simulators—innovative tools that have transformed the way aspiring traders and seasoned investors alike grasp the dynamics of buying and selling. These virtual platforms provide a risk-free environment, allowing users to experiment with strategies, witness real-time market fluctuations, and build confidence without the fear of financial loss.

By immersing oneself in a simulated trading experience, individuals can demystify the often daunting concepts of liquidity, volatility, and market sentiment, ultimately fostering a deeper comprehension of how real markets operate. Whether you’re a novice eager to learn or a veteran aiming to refine your skills, trading simulators offer an invaluable gateway to mastering the art of trading.

Understanding Market Mechanics Through Simulation

Bar replay free feature provides a unique lens through which both novice and seasoned traders can observe and engage with financial ecosystems, allowing them to truly grasp the intricate dance of market mechanics. These digital platforms create a dynamic environment where one can experiment with various strategies without the peril of real-world stakes.

Picture this: experimenting with high-frequency trading tactics, testing the waters of momentum investing, or even navigating through a sudden market crash—all from the safety of a simulated trading floor. The immediacy of feedback on each decision, be it a profit or a loss, allows users to dissect their choices, understand the ripple effects of market sentiment, and develop a nuanced comprehension of supply and demand dynamics.

As algorithms churn and market conditions fluctuate, the depth of insight gained becomes invaluable, transforming abstract theories into tangible knowledge that can later be applied in the real world. In essence, trading simulators serve as a crucible for learning, merging experiential understanding with intuitive decision-making skills.

Real-Time Data and Market News Simulation

In the dynamic world of trading, staying abreast of real-time data and market news is paramount, and this is precisely where trading simulators shine. Imagine immersing yourself in a virtual environment that mirrors the frenetic pulse of the market—stock prices fluctuate, news breaks, and you respond.

These simulators not only replicate the complexities of market mechanics but also challenge you to react swiftly and strategically. As you navigate through changing scenarios, you’ll discover how geopolitical events can send ripples across stock prices or how economic indicators can shape investor sentiment.

It’s a dance of data and decisions, where every fraction of a second counts, and your ability to analyze and anticipate can make the difference between profit and loss. By harnessing these simulations, traders can refine their skills and deepen their understanding of market intricacies, all while experiencing the thrill of the trading floor from the comfort of their home.

Transitioning from Simulated to Real Trading

Transitioning from simulated to real trading can feel like stepping off a ledge into the unknown, as the familiar confines of a controlled environment give way to the unpredictable nature of live markets. In practice, the stakes are markedly higher, and the emotional weight of each decision looms large.

Where once you could execute trades with the click of a button, now every choice is infused with the strong currents of fear and greed. It’s essential to carry forward the insights gained from your simulations—understanding price movements, honing your technical analysis skills, and recognizing patterns that often eluded you before.

However, be prepared for the jarring reality that market conditions can shift rapidly, and the rules learned in a simulator may be tested in real time. Embrace this challenge as a vital step in your trading journey, one where adaptability and a solid risk management strategy become your allies in navigating the chaotic yet exhilarating world of real trading.

Conclusion

In conclusion, trading simulators serve as invaluable tools for both novice and experienced traders looking to deepen their understanding of market mechanics. By providing a risk-free environment to practice strategies and analyze market behavior, these simulators empower users to make informed decisions.

Features like the bar replay free option elevate the learning experience by allowing traders to revisit specific market conditions and refine their techniques based on historical data. Ultimately, harnessing the power of trading simulators can significantly enhance one’s ability to navigate the complexities of the financial market, leading to more successful trading outcomes.